Highlights of Dematerialization and the Security and Exchange

Commission’s new rules on destruction of certificates

by Bob Kerstein, CEO Scripophily.com

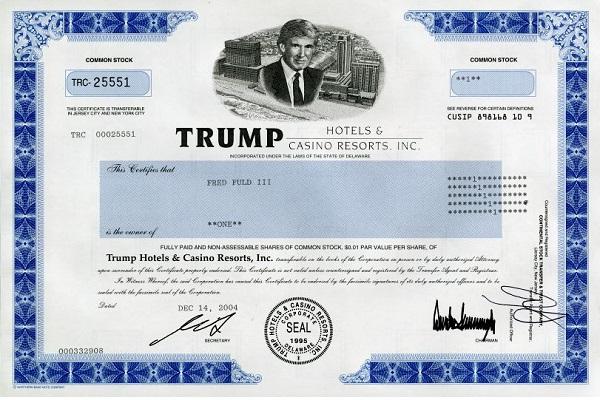

While the hobby of Scripophily continues to grow, it appears the supply of new certificates reaching the collector market will be on the decline. Fewer certificates will be printed on the front end and cancelled certificate will be destroyed faster on the back end. These two important new developments will have an impact the to the field of Scripophily and are summarized below:

1) Dematerialization and

2) Security and Exchange Commissions new rules regarding the controlled destruction of cancelled security certificates

Dematerialization

As a result of the high costs associated with issuing paper certificates, many stock exchanges and countries around the world no longer require the issuing of paper certificates. Stock brokerage firms and many if the issuing company’s enthusiastically support this effort which is called “Dematerialization”.

Dematerialization is the move from issuing physical certificates to electronic book keeping. Actual stock certificates are slowly being removed and retired from circulation in exchange for electronic recording. With the age of computers and the Depository Trust Company’s new Direct Registration System , securities no longer need to be in paper form to be issued in an individual’s name. They can be registered and transferred electronically. One of the main reason’s investors wanted to obtain paper stock certificates was to have them issued in their name and not in a stock broker’s name.

Direct Registration System (“DRS”) enables investors to hold securities positions in their names directly on the books of the transfer agent or issuer. In addition, DRS allows shares to be transferred between a transfer agent and a broker electronically, with such transfers backed by a surety for safety.

AT&T Corp. became the first company in the United States to no loner issue paper certificates. Investors now receive a computer generated report showing them how many shares they have outstanding. This will undoubtedly be a trend more companies will follow.

For those company’s that still issue stock certificates, it can be very expensive to have them issued in your name. To go through a stock broker, you will have to pay the trading price of the stock, plus the commission the broker charges, plus a stock issuance fee. Depending on who you use as a stock broker, the commissions can be anywhere from $15 to $50 and the stock issuance fee can be anywhere from $50 to $100 per certificate. Due to the high cost of processing, risk of loss of certificates, handling costs, etc, it is clear the trend is towards the elimination of paper stock certificate.

Security and Exchange Commission’s new rules regarding the controlled destruction of cancelled security certificates

On January 22, 2004, the SEC’c new rules will become effective for Processing Requirements for Cancelled Security Certificates. The Securities and Exchange Commission revised rules for governing cancelled securities certificates are suppose to improve the processing of securities certificates by transfer agents. The Commission is adopting a new rule under the Securities Exchange Act of 1934 that will require every transfer agent to establish and implement written procedures for the cancellation, storage, transportation, destruction, or other disposition of securities certificates. This rule will require transfer agents to: mark each cancelled securities certificate with the word “cancelled”; maintain a secure storage area for cancelled certificates; maintain a retrievable database of all of its cancelled, destroyed, or otherwise disposed of certificates; and have specific procedures for the destruction of cancelled certificates. Additionally, the Commission is amending its lost and stolen securities rule and its transfer agent safekeeping rule to make it clear that these rules apply to unissued and cancelled certificates.

According to the Securities and Exchange Commission, the new rule and rule amendments promote several fundamental Commission goals: improving the safety and efficiency in processing and transferring securities; reducing or eliminating the physical movement of securities certificates; and reducing the potential for fraudulent use of cancelled securities certificates. The rules primarily relate to problems and costs associated with cancelled securities certificates.

In particular, the SEC is concerned that, until properly destroyed or disposed of, cancelled securities certificates can resurface in the marketplace and can be and have been used to defraud members of the public or financial institutions. Requiring better procedures for processing and destroying cancelled certificates will reduce this potential for harm.

The Commission received 13 comment letters on the proposed rule and proposed rule amendments.Ten commenters generally expressed support for proposed Rule 17Ad-19 and the proposed amendments to Rules 17f-1 and 17Ad-12 and for the Commission’s efforts to address cancelled certificate fraud, and offered suggestions for modification or requests for clarification with respect to specific provisions of the proposal. As discussed below, we have adopted some of the suggestions. The remaining three commenters addressed only the issue of certificate destruction, arguing that because securities certificates are culturally important due to their historical, aesthetic, and collectors’ values, they should be preserved and not destroyed.

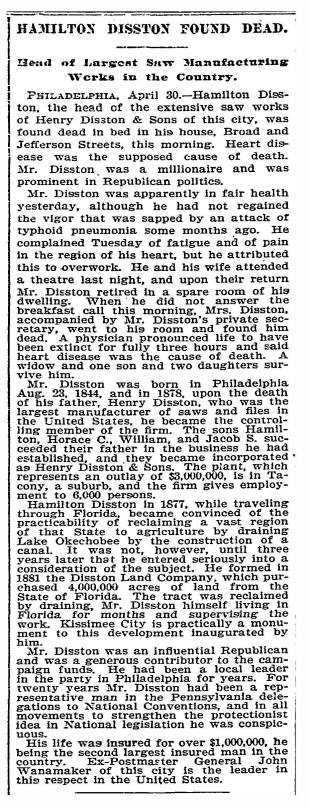

History

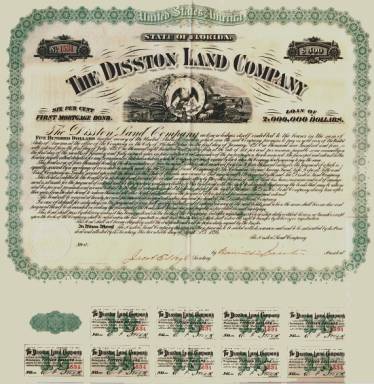

When a security certificate is retired, such as when a bond is redeemed or ownership of stock is transferred, the certificate is cancelled by the transfer agent. Cancellation normally involves both an accounting entry on the books of the transfer agent and an alteration of the certificate itself, though either by itself is an act of cancellation. After cancellation of a registered certificate, the Exchange Act’s record retention rules for transfer agents require that the certificate or appropriate record of the certificate be retained for not less than six years. In recent years, many corporate bond issues have been called for redemption and cancelled decades before their maturities. These bond redemptions and an active stock market have generated vast amounts of cancelled securities certificates that must be processed, stored, and safeguarded. Certificate processing of retired certificates can involve significant costs and risks. The following examples illustrate some of these risks.

In a 1992 case, cancelled bond certificates with a face amount of approximately $111 billion disappeared after being delivered from a transfer agent’s warehouse to a certificate destruction vendor. The certificates, issued by many well-known public companies, later began to resurface worldwide. A number of banks and brokers as well as individuals were defrauded through sales of the cancelled certificates for cash or through use of the cancelled certificates as loan collateral. The bulk of these cancelled certificates still remain unaccounted for and continue to resurface in the marketplace.

In a similar case in 1994, cancelled bonds with a face amount of approximately $6 billion disappeared after being delivered from a transfer agent’s record center to two certificate destruction vendors. The cancelled certificates, issued by well-known companies, later began to resurface worldwide. Again, the bulk of these cancelled certificates remain unaccounted for and continue to resurface in the marketplace.

In another instance, a transfer agent’s shipping bags filled with cancelled certificates were stolen while in commercial air transit. The transfer agent regularly shipped cancelled certificates from the West Coast to a New York bank for processing. The transfer agent, however, did not record the contents of its shipments and, in effect, relied on its New York bank processing agent to do its bookkeeping. When the shipping bags were stolen, neither the transfer agent nor its bank processing agent realized that the certificates were missing. A number of the certificates later resurfaced in off-market transactions.

Other instances have involved bulk thefts of cancelled certificates from warehouses. In some cases, the records of the certificate numbers of the stored certificates also were stolen because they were stored with the certificates. Even in cases where certificate records for stolen securities were available, they generally were of limited value in identifying the stolen securities because the records were organized chronologically by cancellation dates rather than by certificate numbers. As a result, the necessary information was not easily retrievable from the records.

A common transfer agent practice contributed to this widespread problem. In physically cancelling certificates, many transfer agents marked the certificates only with pinhole-sized perforations. These tiny perforations were intended to indicate cancelled status without defacing the certificates and impairing their usefulness as records. The pinholes, which usually show the cancellation date and the initials of the transfer agent within a space about the size of a quarter, often have been barely noticeable. In some cases, they have been mistaken for notary or authentication markings. Even more problematic has been the practice by some transfer agents of not marking certificates at all to indicate that the certificates have been cancelled.

In many cases, the stolen certificates have reentered the marketplace either through sales or as collateral for loans, resulting in substantial fraud on public investors, public companies, creditors, broker-dealers, and transfer agents. Not only do situations such as these present potential liability for the transfer agents responsible, but they consume the resources of regulatory and criminal law enforcement agencies.

As discussed below, the Commission hopes that these unfortunate practices have been or are being eliminated by the transfer agents themselves through improved trade practices. But without standards and verification, there is no way to be certain. The new rule and rule amendments address these practices and will permit the Commission’s examiners to verify compliance as a routine part of their examination schedules.

Final Rules

Currently, the processing of cancelled certificates is largely governed by industry practices. For example, in 1994, the Securities Transfer Association (“STA”), the largest transfer agent trade association, adopted guidelines for its members which, among other things, called for marking cancelled certificates with the word “cancelled” and for greater security measures in certificate storage and destruction. However, these guidelines are not mandatory, and not all transfer agents follow them. Therefore, because cancellation is the critical first step in the processing of retired securities certificates, we believe that rulemaking is necessary to strengthen and standardize this process.

Rule 17Ad-19 requires each transfer agent to have and implement written procedures for the cancellation, storage, transportation, destruction, or other disposition of securities certificates. At a minimum, the written procedures must provide: (1) for controlled access to any cancelled certificate facility; (2) that the transfer agent clearly apply to the face of each cancelled certificate the word “cancelled” unless the transfer agent’s procedures will cause the certificate to be destroyed in accordance with other Commission rules within three business days of its cancellation; (3) that the transfer agent keep a readily retrievable record of each cancelled certificate with identifying data consisting of CUSIP number, certificate number including prefix or suffix, denomination, registration, issue date, and cancellation date; (4) that the transportation of cancelled certificates be made in a secure manner with a record of the certificates in transit kept separately; (5) that the transfer agent keep a readily retrievable record of each destroyed certificate or certificate otherwise disposed of; and (6) that authorized personnel of the transfer agent, supervise, witness and document the destruction of certificates.

We are modifying proposed Rule 17Ad-19 to require that transfer agents maintain records not only of the certificates that they or their agents destroy but also of those certificates that they dispose of by any other means and which may, for example, become the property of collectors or dealers in collectibles. In this regard, we note that cancelled certificates, after a period in transfer agent storage, are generally destroyed by the transfer agent or destroyed by some other party acting at the direction of the transfer agent or the issuer. However, a small amount of cancelled certificates may find their way from transfer agents to collectors or perhaps to other places currently unknown to us. Accordingly, to make the rule as complete as possible, we are inserting in paragraph (b) the words “or other disposition” into the phrase “destruction of securities certificates.” The term “otherwise disposed of” requires that a record be maintained of how (as by sale or gift) and to whom (with name and address) the certificates were disposed of and the date of disposition.

As of December 31, 2002, certificates reported lost or stolen reflected securities with a value of approximately $672 billion. There were 26,011 reporting institutions. During the year 2002, reports were made on 926,475 certificates (an average of 3,676 certificates per business day); inquiries were made on 5,231,310 certificates (an average of 20,759 certificates per business day); and matches or “hits” resulting from inquiries occurred on 224,338 certificates, which had a value of approximately $36.5 billion. The hits essentially warned the inquirers that the certificates had been reported as lost, stolen, missing, or counterfeit and were not eligible for transfer.

Maintaining Certificates as Collectors’ Items

The Proposing Release requested comments on whether the Commission should mandate the destruction of cancelled certificates within thirty days of their cancellation. Three commenters, a finance professor, a non-public corporation, and the president of a securities certificate collectors’ organization (Bob Kerstein), argued against destroying old securities certificates because of their importance to financial history, their aesthetic merits, and their value to collectors in a field known as Scripophily.

We are sensitive to these interests. We believe that the adoption of sound recordkeeping, safeguarding, and destruction procedures will greatly reduce the risk of improper use of cancelled certificates. Therefore, we do not believe it is necessary at this time to mandate destruction.

In this regard, we note that cancelled securities certificates, after a period in transfer agent storage, are generally destroyed by the transfer agent or destroyed by some other party at the direction of the transfer agent or the issuer. However, a small amount of cancelled securities certificates find their way from transfer agents into collectors’ markets. Accordingly, to make the rule as complete as possible, we are modifying proposed Rule 17Ad-19 to require that transfer agents maintain records not only of the certificates that they or their agents destroy but also of those certificates that they dispose of by any other means, such as by sale to collectors or to dealers for collectors. For certificates disposed of by such other means, transfer agents are required to maintain records of how the certificates were disposed and to whom, with such party’s name and address, and the date of disposition.

The Commission received comment letters from five transfer agents, one broker-dealer, one bank, one business corporation, one trade group representing transfer agents, one trade group representing investment companies, the president of an organization representing collectors of securities certificates, a finance professor, and a group of business students at Florida State University. Letters from James J. Angel, Ph.D., George Washington University (October 19, 2000); Loren Hanson, Manager, Shareholder Relations, Otter Tail Power Co. (October 24, 2000); Frank Hammelbacher, Norrico, Inc. (October 30, 2000); John E. Nolan, Senior Vice President, Raymond James & Associates, Inc. (November 2, 2000); Charles V. Rossi, Division President, EquiServe (December 4, 2000); Steven Turowski, Senior Regulatory Counsel, PFPC Inc. (December 4, 2000); Kathleen C. Joaquin, Director, Transfer Agency & International Operations, Investment Company Institute (“ICI”)(December 5, 2000); Daniel M. Hill, Assistant Vice President, U.S. Bank Trust National Association (December 6, 2000); John F. Kuntz, Vice President and Assistant General Counsel, Chase-Mellon Shareholder Services (December 14, 2000); Keith G. Berkheimer, President, CTA (December 14, 2000); Robert A. Kerstein, President, Scripophily.com (March 5, 2001); and Robert Serrano et al, business students at Florida State University (dated November 29, 2000, received at the Commission February 19, 2002). These comment letters are available for inspection and copying in the Commission’s Public Reference Room, 450 Fifth Street, NW, Washington, DC 20549.

Much of the above information was obtained from the Securities and Exchanged Commission’s website. To get a full text of the new rules, Please Click Here.

We are always looking for articles about the hobby. Please us know if you have any suggestions Email