Liberty Bonds

“Capitalizing on American Pride and Patriotism: Funding the First World War Through the Liberty and Victory Loan Bonds, 1917-1923,” by Lawrence D. Schuffman, Paper Money, January/February 2009

The information below is Courtesy of LibertyBonds.com.

Liberty bonds were first utilized during the first World War to support the allied cause in World War I. Subscribing to the bonds became a symbol of patriotic duty in the United States and introduced the idea of financial securities to many citizens for the first time. This allowed private citizens to purchase a bond to help support the military effort. After the war, the bond could be redeemed for its purchase price plus interest.

A Liberty bond will have a maturation date somewhere on the front on the bond. A maturation date is the earliest someone can redeem the value plus interest. Liberty Bonds from WWI do not continue to earn interest. The redemption value is usually the face value of the bond plus any unused coupons attached to the bond.

There were four issues of Liberty Bonds:

- Apr 24, 1917 Emergency Loan Act authorizes issue of $5 billion in bonds at 3.5 percent.

- Oct 1, 1917 Second Liberty Loan offers $3 billion in bonds at 4 percent.

- Apr 5, 1918 Third Liberty Loan offers $3 billion in bonds at 4.5 percent.

- Sep 28, 1918 Fourth Liberty Loan offers $6 billion in bonds at 4.25 percent.

| Jul 28, 1914 | World War I begins with Austria-Hungary’s declaration of war against Serbia. |

| Jul 31, 1914 | New York Stock Exchange closes because of European Crisis. (Reopens Dec. 12). |

| Aug 1914 | Emergency currency is issued under Aldrich Vreeland Act. |

| Aug 1, 1914 | German declares war on Russia (France on Aug. 3, Britain on Aug. 4). Austria-Hungary declares war on Russia and Japan declares war on Germany in August. |

| Nov 16, 1914 | Federal Reserve Banks open for business. |

| Jan 25, 1915 | Telephone service begins between New York and San Francisco. |

| Oct 15, 1915 | U.S. bankers float $500 million loan to Britain and France at 5 percent. |

| Sep 8, 1916 | Emergency Revenue Act doubles income tax rates, adds estate tax and munitions profits tax, and establishes Tariff Commission. |

| Nov 7, 1916 | Wilson is reelected as President. |

| Feb 3, 1917 | USS “Housatonic” is sunk by German submarine, and U.S. breaks diplomatic relations with Germany. |

| Mar 3, 1917 | Special Preparedness Fund Act provides for excess profit taxes and higher inheritance taxes. |

| Apr 2, 1917 | Wilson calls special session of Congress for declaration of war against Germany. (On April 4, Senate votes for war and house concurs on April 6.) |

| Apr 24, 1917 | Emergency Loan Act authorizes issue of $5 billion in bonds at 3.5 percent. |

| Jun 21, 1917 | Federal Reserve Act is amended to encourage membership, mobilize gold reserves, and facilitate issue of notes. |

| Oct 1, 1917 | Second Liberty Loan offers $3 billion in bonds at 4 percent. |

| Oct 3, 1917 | War Revenue Act doubles income taxes, provides for excess profits tax, and imposes many excises. |

| Nov 6, 1917 | Russian Bolshevist overthrow Kerensky’s Provisional Government, placing Lenin in power. |

| Dec 7, 1917 | U.S. declares war on Austria-Hungary. |

| Dec 26, 1917 | The U.S. Railroad Administration takes charge of the nation’s railroads. |

| Apr 5, 1918 | Third Liberty Loan offers $3 billion in bonds at 4.5 percent. |

| Sep 28, 1918 | Fourth Liberty Loan offers $6 billion in bonds at 4.25 percent. |

|

Images courtesy of LibertyBonds.com |

|

Liberty Loan of 1917 (United States Government) 1917 $100. Blue “50 THREE AND ONE HALF PERCENT” and Treasury Seal. Thomas Jefferson, left. Statue of Liberty, right. orange eagle and Columbia statue on back. Embossed large Treasury seal above register’s name.

Second Liberty Loan Converted 4 1/4% Gold Bond of 1927-1942 (United States Government) 1918. $100. Coupons to the side and underneath. Brilliant yellow-orange underprint and “SECOND LIBERTY LOAN CONVERTED”. Blue Treasury Seal. Andrew Jackson. Torch, bottom. Orange Columbia above Capitol with flag and Statue of Liberty on the back. Facsimile signatures of Teehee and McAdoo. Issued under the Act of May 9, 1918.

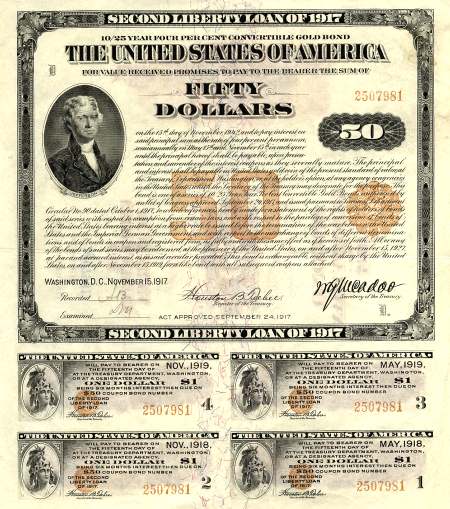

Third Liberty Loan 4 1/4% Gold Bond of 1928 (United States Government) 1918. $50. Red underprint and “THIRD LIBERTY LOAN”. Blue treasury seal. Thomas Jefferson. Torch, below. Brown bald eagle on reverse. Facsimile signatures of Teehee and McAdoo.

Third Liberty Loan 4 1/4% Gold Bond of 1928 (United States Government) 1918. $1000. Red underprint and “THIRD LIBERTY LOAN”. Blue treasury seal. Abraham Lincoln. Torch, below. Green bald eagle on reverse. Facsimile signatures of Teehee and McAdoo. Approved under the Act of April 24, 1917 this Liberty Loan bond was authorized to raise funds to help win the first World War.

Fourth Liberty Loan 4 1/4% Gold Bond of 1933-1938 (United States Government) 1918. $50. Green underprint and “FOURTH LIBERTY LOAN”. Red treasury seal. Thomas Jefferson. Torch, below. Brown Justice on the reverse. Facsimile signatures of Teehee and McAdoo.

Fourth Liberty Loan 4 1/4% Gold Bond of 1933-1938 (United States Government) 1918. $100.. Green underprint and “FOURTH LIBERTY LOAN”. Red treasury seal. Andrew Jackson. Torch, below. Orange Justice on the reverse. Facsimile signatures of Teehee and McAdoo.

Fourth Liberty Loan 4 1/4% Bond of 1933-1938 (United States Government) 1918. $500. Coupons to the side and underneath.Green underprint and “FOURTH LIBERTY LOAN”. Red treasury seal. George Washington. Torch, below. Blue Justice on the reverse. Facsimile signatures of Teehee and McAdoo.

Liberty Loan of 1917 (United States Government) 1917. $50. Blue “50 THREE AND ONE HALF PERCENT” and Treasury Seal. Thomas Jefferson, left. Statue of Liberty, right. Brown eagle and Columbia statue on back. Embossed large Treasury seal above register’s name. The original series of eighty coupons are bound to the side with none clipped.

United States of America (USA) 1918. Third Liberty Loan.. $50. 4 1/4% Gold Bond of 1928. No coupons. Red “THIRD LIBERTY LOAN”. Red treasury seal. Thomas Jefferson. Facsimile signatures of Teehee and McAdoo.

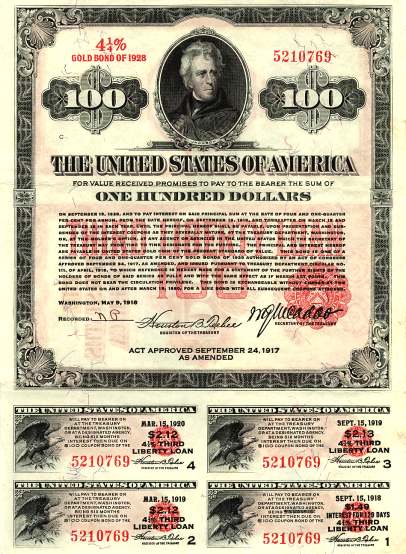

United States of America (USA) 1918. Third Liberty Loan. $100. 4 1/4% Gold Bond of 1928. All four coupons attached. Red “THIRD LIBERTY LOAN”. Red treasury seal. Andrew Jackson. Facsimile signatures of Teehee and McAdoo. These bonds were sold with only four coupons attached.

United States of America (USA) 1918. Third Liberty Loan.. $100. 4 1/4% Gold Bond of 1928. All four coupons attached. Red “THIRD LIBERTY LOAN”. Red treasury seal. Andrew Jackson. Facsimile signatures of Teehee and McAdoo.

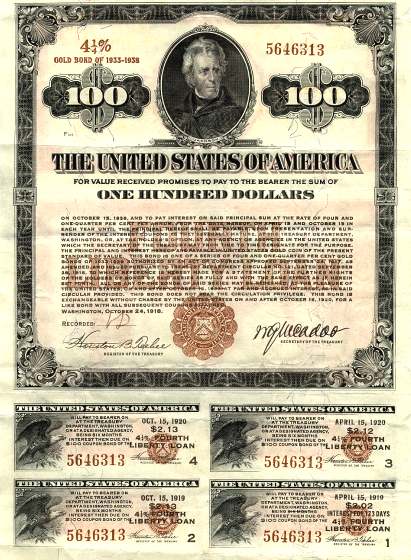

United States of America (USA) 1918. Fourth Liberty Loan. $50. 4 1/4% Gold Bond of 1933-1938. All four coupons attached. Brown “FOURTH LIBERTY LOAN”. Brown treasury seal. Andrew Jackson. Facsimile signatures of Teehee and McAdoo.

United States of America (USA) 1918. Fourth Liberty Loan. $100. 4 1/4% Gold Bond of 1933-1938. All four coupons attached. Brown “FOURTH LIBERTY LOAN”. Brown treasury seal. Andrew Jackson. Facsimile signatures of Teehee and McAdoo.

United States of America (USA) 1919. Victory Liberty Loan. $50. 4 3/4 Convertible Gold Note of 1922-23. Coupons underneath and to the side. Blue underprint and treasury seal. Thomas Jefferson. Brown eagle on reverse.

United States of America (USA) 1919. Victory Liberty Loan. $100. 4 3/4% Convertible Gold Note of 1922-1923. Coupons underneath and to the side. Blue underprint and treasury seal. Andrew Jackson. Orange eagle on reverse.

United States Government Liberty Loan Bond Specimen. $10. Participation Certificate. Brown. Eagle atop rock, left. ABN.

United States of America 1918. Treasury Department Authorized Agent Certificate. Blue with gold highlights. Eagle with shield. Printed signature of McAdoo.

|