Czech Scripophily: A Story of Love, Beer and Broken Promises By Jeremy Monk, AKRO investiční společnost, a.s.

By Jeremy Monk, AKRO investiční společnost, a.s.

More than Just a Pretty Picture!

Scripophily isn’t the name of some rare disease, but rather a specialised branch of numismatics focused on the study and collection of old stocks and bonds. The word is derived from the English word “scrip” which represents an ownership right and the Greek word “philos” means to love. At AKRO, we have adorned the walls of our offices not with photos or paintings but with old stock and bond certificates. Such furnishings seem particularly fitting for a mutual fund group whose activities are focused on such investments.

Over the years, thousands of companies have at one time or another issued share and/or bond certificates. It is therefore possible to focus on almost any theme to start a collection. The railway and automotive industries are particular favourites amongst Scripophilists. Thematic collections can include anything from corporate scandals (Enron, Global Crossing,) to erotica (Nevada brothels, Playboy Inc., Beate Uhse). I will confess that my collection at AKRO, and at home, is rather eclectic in nature; a mixture of the decorative and the historically interesting. It includes some lavishly illustrated foreign certificates issued by Louis Bleriot, Claridges Hotels, The Port of Bruges, and Societe Paris-France S.A. The majority of the collection is however focused on old Czech certificates.

Czech Collectors: Spoilt for Choice

The Czech Republic represents a fruitful source of old shares and bonds. In countries such as the US and UK, old certificates are only normally available in companies that:

- Went into bankruptcy (and the owners just kept the certificates);

- Whose shares, when cancelled upon sale, were for whatever reason never destroyed by the transfer agents;

- And shares where specimens (of what was printed) and poofs (of what will be printed) have survived.

In the Czech Republic, on the other hand, political change under communism meant most shareholders just kept their shares in the their bottom draw in the hope that one day they would have some value. As a consequence, at lot of certificates remain in numerous Czech companies. Czech collectors are therefore spoilt for choice!

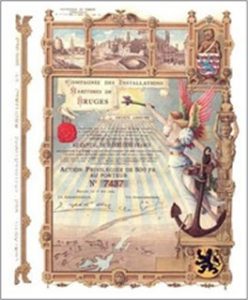

Left: Certificate from the Compagnie Des Installations Maritimes De Bruges issued in 1904. The company was formed in 1895 to construct the port installations and a canal at Bruges. Widely acknowledged as one of the most beautiful certificates ever made. Source: Scripophily.com – The Gift of History

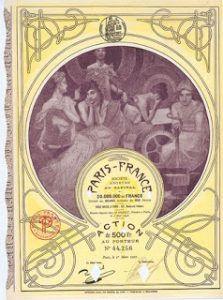

Right: Paris-France S.A., issued 1927, and illustrated by Alfonse Mucha. Paris-France S.A. was incorporated in 1898 to establish a shop in Paris to sell high quality clothing and other items. Alfonse Mucha was retained to illustrate their certificates. Source: gutowski.de

Top: Cheers! Smichov Brewery, issued 1939. Featuring a large vignette of a seated King holding a beer. The company was formed in 1869. Its products can still be enjoyed today. Source: Author’s private collection.

Do these shares have any value?

To some extent, it rather depends how you define value. Certainly many have considerable aesthetic value whilst others may be regarded as of historic value. In some cases, old stocks and bonds may even have some intrinsic value. Like most collectibles overall scarcity and condition also play a part with regard to value.

Old certificates can be purchased on general websites such as ebay or aukro. Specialist websites and auctions also exist, e.g. hwph.com, fhw-online.de. International auction houses, such as Spink and Bonhams, have also held Scripophily auctions. Interesting certificates can be bought for a few hundred or a few thousand Euros. Rare certificates can, however, fetch significantly more.

The Aesthetic Value

Old Certificates, particularly those issued during the nineteenth and early twentieth century are usually beautifully illustrated. Like banknotes, intricate engravings were used to limit the scope for forgeries. Indeed, many of the same printers, engravers and artists were used in the production of stock and bond certificates as for banknotes and postage stamps. It was also felt that an elaborate illustration was a sign of good things to come! An early form of corporate promotion. Unfortunately, not all certificates have the artist’s name. Czech artists whose work appears on certificates include: Alfonse Mucha, Josef Herčík, Emanuel Bohač, and Cyril Bouda.

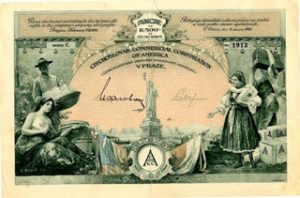

Left: Czechoslovak Commercial Corporation of America, issued 1926. Illustrated by E. Bohac. The company aided the emigration of Czechs to America. Note the symbolism of the Czech figures on the right with their luggage, the rich and fertile land that awaits them, and the Statue of Liberty that beckons. Source: Scripophily.com – The Gift of History

Historic Value

Through surviving certificates it is possible to trace the evolution of our modern capital markets from their origins in the seventeenth century to the present day. In many cases, these certificates are the only tangible remains of enterprises, great and small, successful or failed, and the colourful personalities often associated with them.

Some of the most sought after shares are those issued by The Dutch East India Company, which was Holland’s biggest trading company during the 17th and 18th centuries. It was also the world’s first joint-stock limited liability company with freely transferable shares. The public share subscription ended on September 1st 1602. It is a share in The Dutch East India Company, dated 1606, which is regarded as the oldest known share in existence. The ultimate success of the Dutch East India Company, and other similar companies shortly thereafter, secured the limited liability company as the foundation stone of modern finance. Whilst Czech certificates are not so old, many also have historical significance.

The availability of historic bonds and shares tells us a lot about the relative historic importance of industries to countries. Given the vast expanse of America, not surprisingly, old railroad shares are very easily found in North American reflecting the railway boom of the nineteenth and early twentieth centuries. In Africa, Australia, Canada, mining shares predominate. What then of the Czech Republic? Well, you guessed it, for Czech Scripophilists, by far the most represented industry, measured by the availability of historic shares, is the brewing industry! Not surprising given the historic importance of the beer industry to the Czech Republic. Indeed, in 1931, tiny Czechoslovakia was ranked 6th in the world in terms of beer production being home to some 430 breweries.

The Czech market isn’t just about collecting brewery shares. As one of Europe’s most advanced economies almost every industry is represented, from automobiles (Skoda) to banking (Zivnostenka banka). Furthermore, in the era before electronic signatures, old stocks and bonds often bear the signatures of yesteryear’s entrepreneurs. For autograph collectors, old certificates can be valuable source of authentic signatures.

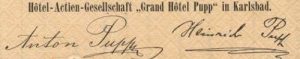

Anton Pupp, 1841-1907 Heinrich Pupp 1850-1931 Grand Hotel Pupp

The signatures of Anton and Heinrich Pupp appear on share certificates, issued in 1898, to finance the building of the Hotel Grand Pupp in Karlovy Vary (Carlsbad). Source: Securityprinting.org, Pupp.cz

With the recent popularity of ‘crowdfunding’, it is worth reflecting on the fact that the Czech Republic has a rich and proud history of public subscription to projects deemed of national significance, be it the National Theatre, the repair of St Vitas Cathedral or Petrin Tower. The internet has merely given new life to an old idea.

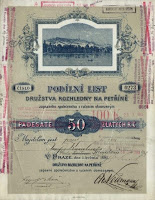

Left and centre: Public subscription to finance of the View Tower on Petrin Hill, issued 1891, was an example of successful Crowd funding. In March 1891 the building of the tower started for the General Land Centennial Exhibition. It was finished in only four months. The building of The National Theatre and the renovation of St. Vitus Cathedral were financed in a similar way. Source: Securityprinting.org, Wikipedia

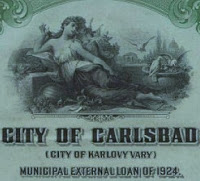

Right: City of Carlsbad (Karlovy Vary) municipal loan, issued in dollars and linked to the gold price. One of the pre-war bonds subject to a 1984 agreement. Source: Author’s private collection

On a less uplifting note, securities linked to the scandalous voucher privatisations of the 1990’s act as a reminder of the endemic deceit and fraud that has so undermined trust in the Czech capital market.

Intrinsic Value

Just because a security is old doesn’t mean it has no intrinsic value. In a previous article, I noted the recent repayment of debt by the UK government that originated from the South Sea Bubble of 1720! The very oldest active bond is a perpetual bond issued by the Dutch Water Board of Lekdijk Bovendams on May 15, 1648, to finance the repair of a dike. Now owned by Yale University, the bond still pays interest.

On occasions, even hitherto defaulted bonds can also turn out to have some intrinsic value left in them. My first experience of this was in 1987, when the Chinese government quietly paid-off the British holders of Chinese government bonds issued before 1949, when the communists came to power. The most prominent was a GBP25m sterling bond issued in 1913, indexed to the price of gold, which was to mature in 1960. The desire of the Chinese government to issue new bonds in the late 1980’s prompted the settlement. Traditionally, The London Stock Exchange has refused to list securities issued by defaulters therefore providing an incentive for a settlement.

Settlements in eastern-Europe have included: Poland, Bulgaria and Romania. Many Czech pre-war dollar denominated bonds were subject to a settlement in 1984/6. However, many of these bonds would appear not to have received the payment indicated in the agreement. The evidence suggests that the Czechoslovak government never fully honoured the agreement.

What can we learn from Scripophily?

Old stock and bond certificates often represent extremely decorative pieces of commercial art illustrated by the leading contemporary artists of their day. However, old stocks and bonds are also important because they represent tangible reminders of our financial history. The successes, failures, booms, busts, entrepreneurs, fraudsters, ongoing controversies, are all represented. Hopefully, by reflecting on past experience, today’s investors can make better decisions. How can investors commit to buying a long-dated Czech government bond without first noting the ongoing treatment of bondholders subject to a bond-holders agreement signed 30 years ago?

For more than 400 years, ever since the successful formation of the Dutch East India Company, public subscription to joint stock companies has been the foundation stone of modern corporate finance. On the whole, it has been a story of economic success and progress. However, it is sobering to think that most old certificates represent investments that, for one reason or another, are now worthless. The reasons for their failure are manifold: politics, war, new technologies, economic decline, incompetence, fraud or just plain bad luck. Investors who blithely ignore these risks, and focus just on the present, ignoring history, are worse investors because of it.

A surprisingly high number of bonds, especially sovereign and municipal bonds, even after default, ultimately yield at least a nominal return. For example, since its formation in 1933 until its effective demise, the Foreign Bondholders Protective Council brokered more than 50 settlements. The message is clear, never ever, throw away a seemingly worthless certificate. In the future, it may well have some artistic, historic or even intrinsic value. You never know your luck!

For investors and collectors alike, Scripophily is indeed about more than just a pretty picture.

Jeremy Monk

Investment Director

AKRO investiční společnost, a.s.

19th April, 2016

I would like to a acknowledge the help of Vladimir Gutowski (Gutowski.de), Jiří Jaroš (securityprinting.org), Bob Kerstein (Scripophily.com – The Gift of History) and Jitka Markusová (Grandhotel Pupp) for kindly letting me illustrate the article with photographs from their websites. A special thanks to Stanford University Libraries who provided me with copies of the 1984 and 1986 original signed agreements between the Foreign Bondholders Protective Council and Czechoslovak state.

This article does not constitute investment advice or a recommendation to buy or sell any security. The opinions expressed in this article are the author’s and do not necessarily represent the views of AKRO investiční společnost, a.s. Examples of the certificates illustrated in this article are held in the author’s private collection including the pre-war Czech dollar denominated bonds issued by the Czechoslovak State, Karlovy Vary (Carlsbad) and City of Greater Prague.